Dean:+886-2-2658-5801#5020 / cob_chief1@takming.edu.tw

Secretary:+886-2-2658-5801#5021 / wphsiu@takming.edu.twThe College of Finance was established in 2007 when our was promoted to a university of science and technology. Currently, the college consists of four departments: the Department of Accounting Information, the Department of Public Finance and Taxation, the Department of Risk Management and Wealth Planning, and the Department of Banking and Finance (including the Real Estate Finance and Investment Management Program, the Digital Finance Program, and the Master’s Program of Financial Planning and Taxation Management). There are 55 full-time teachers working in the college, 81.8% of whom are qualified Assistant Professors.

According to the educational tenets and ideas of our university, our educational objectives are to nurture students with professional knowledge and professional ethics, and to provide them with four core competencies, which are as follows: professional knowledge about management skills; digital, smart, new financial knowledge and application skills; ethics, legal knowledge, and skills; and the ability to broaden an international perspective.

To enhance the competitiveness and employability of students at the college, we constructed a blueprint for practical talent incubation, namely “industry expert instruction – industry-university collaboration – professional internship – graduation means employment”. In addition to introducing a professional certificate mock-up system, we established complete resource of certificate questions database, promoted accreditation on professional courses, and assisted students with obtaining certificates and developing their future employability through offering a certificate training program and incentives.

Through our active collaboration with industry and the establishment of long-term internship relationships with the industry, we arrange off-campus internships throughout the academic year to not only offer cadres, but also prepare our students for employment and develop workplace ethics, so that professional skills can be effectively matched with practical needs. Additionally, in line with our university's overall development strategy and industry-academic resources, we are committed to promoting research conducted by university faculty and on-campus workshops in order to develop practical expertise at the cutting edge of technical vocational education. Through our active collaboration with industry and the establishment of long-term internship relationships with the industry, we arrange off-campus internships throughout the academic year to not only offer cadres, but also prepare our students for employment and develop workplace ethics, so that professional skills can be effectively matched with practical needs. Additionally, in line with our university's overall development strategy and industry-academic resources, we are committed to promoting research conducted by university faculty and on-campus workshops in order to develop practical expertise at the cutting edge of technical vocational education.

Chairperson:+886-2-2658-5801#5020 / if@takming.edu.tw

Secretary:+886-2-2658-5801#5020 / rich1031@takming.edu.tw

The origins of the Department can be traced back to the Department of Insurance and Financial Management, established in 2000. It is one of the initial three undergraduate departments at our university. A number of alumni have achieved outstanding success, and the Department is highly recognized throughout industrial circles and by parents. In the academic year commencing in September 2020, we obtained approval to change the name to the “Department of Risk Management and Wealth Planning”. We have fully demonstrated our intention to move with the times, and to work diligently to create the basis for the department to pursue the goal of cultivating talents in the financial holdings industry.

To cultivate professional talents with professional knowledge and skills of risk management and wealth planning.

The Department is the only one in Taiwan that has a dual focus of risk management and wealth planning.

We integrate CFP courses in risk, investment, taxation, and retirement planning, ensuring that our students are equipped with the professional competencies required under three categories, including “risk management and insurance”, “wealth management”, and “innovative thinking and interdisciplinary learning”. Additionally, we incorporate new knowledge of FinTech and InsurTech into a professional foundation that develops students’ capabilities in integration and innovation.

We established an exclusive electronic exam venue for the international certificate, LOMA, in Taiwan. It is supported by an “insurance financial and risk management profession certificate mock-up exam system” and a “banking and insurance technology scenario simulation classroom”, combined with a “banking and insurance technology knowledge interactive system” (http://ows.takming.edu.tw) to enhance learning effectiveness.

The Department focuses on a seamless transition to industry after the graduation for students. We focus on internship retention and guaranteed employment after graduation.

Except for a few who carry on with advanced study each year, most of our graduates enter the workplace following graduation. In summary, student outcomes include:

|

|

2021 Internship visit at Taishin International Bank |

Hosting financial activities and taking a group photo by the entrance of the university |

|

|

Internship visit at Chung Kuo Insurance Co., Ltd. |

Alumni gathering at the department |

|

|

New financial insurance future start financial activity |

Vietnamese students at the Department of Risk Management and Wealth Planning visit Cathay Life Insurance Tamsui Educational Center |

|

|

Sharing from Vietnam Cathay Life Insurance Team in |

Presentation of internship feedback |

|

|

Internship visit in CTBC Insurance Co., Ltd. |

Sharing from Vietnam Fubon Life Insurance promotion team |

Chairperson:+886-2-2658-5801#2770 / fb@takming.edu.tw

Secretary:+886-2-2658-5801#2771 / wanchun@takming.edu.tw

The Department of Banking and Finance aims to develop all-round professional talents in banking and finance, as well as cultivating a basis for our students to pursue careers as financial personnel in the banking industry and in other general enterprises. The Department also offers Real Estate Finance and Investment Management Programs, a Digital Finance Program, and a Master’s Program for Financial Planning and Taxation Management. In terms of curriculum design, we focus on both academic theory and practical application, in combination with co-teaching with industrial experts, certificate exam training, and industrial internships to enhance opportunities for students’ diverse development. The master’s program provided by the Department is the first in Taiwan to be established from a client’s perspective for personal financial planning. The main objective of the program is to provide students with the basis to develop the professional talents for personal financial planning and taxation management. It is the best available choice for those interested in professional study of financial consultancy in Taiwan’s banking industry.

Our professional courses all have a modular design that ensures students are able to connect with future career development opportunities after graduation. The courses in the Department of Banking and Finance focus on strengthening students’ practical capabilities through the arrangement of professional certificate guidance and an educational training course to become a Certified Financial Planner (CFP®), and to establish a good foundation for students’ to obtain wealth management advanced professional certification. Meanwhile, the Department uses basic financial planning as the capstone course to supervise students participation in the National Colleges and Universities Wealth Management Contest. Furthermore, the Department facilitates professional internships that lead to a seamless transition into the workplace. This ensures that students can apply what they have learned to real world scenarios and enjoy a smooth start to their careers. The Department offers professional spaces for students to learn in, including an online financial information classroom, and an investment and financial management implementation classroom.

Since its inception, the Department of Banking and Finance has been the first choice for students seeking a career related to business. The Department offers students a path to promising future employment. In particular, our government is working hard to develop Taiwan as the asset management and financing center in Asia, as well as supporting the banking industry to become the flagship industry that drives GDP growth.

While some of our graduates choose to continue advanced study in the graduate school, most find work in the financial departments of general enterprises or organizations in the banking industry, or for financial institutions involved with insurance, securities and futures, and securities investment. Others find work as civil servants in government agencies. Graduates of the master’s program have professionalism in the area of “finance” and can work as all-round financial planning consultants in the future.

|

|

Academic Year 2020 Alumni Gathering (1) |

Academic year 2020 internship performance presentation (1) |

|

|

Academic year 2020 internship performance presentation (2) |

Academic year 2020 internship performance presentation (3) |

|

|

Academic year 2020 internship enterprise joint briefing |

Academic year 2020 internship joint interview (1) |

|

|

Academic year 2020 internship joint interview (2) |

Academic 2021 Student Association of the department- group photo |

|

|

Awarded Runner-UP in 2021 FinTech Banking Service Interscholastic Creativity Competition |

Chairperson:+886-2-2658-5801#2750 / ft@takming.edu.tw

Secretary:+886-2-2658-5801#2751 / sam90936@takming.edu.tw

The Department was established in 1965, and it was one of the key departments when Takming University of Science and Technology was founded. Currently, the main programs the Department offers are for four-year technical students in the day school. The courses aim to develop the skills required for middle management, including professional competencies relating to public finance and taxation, as well as workplace ethics.

The Department’s curriculum is centered on taxation, linking with the professional areas of accounting, financial planning, law, and information. It is supported by internship training in the tax authorities and enterprises, with a focus on practicability and feasibility. To respond to the demand of the employment market, the Department regularly invites off-campus experts and scholars to review and modify the syllabus, curriculum map, and learning access road-career development diagram. The Department emphasizes the transition and progress for each academic module, as well as the direction of futurecareers

The six core competences developed by the department include: managing and applying professional knowledge in taxation and auditing, managing financial knowledge and wealth, analyzing and applying financial information, applying professional knowledge in taxation, developing tax ethics and law, and analyzing international taxation and finance.

To cultivate financial and taxation professional skills, notably “taxation management competence” and “financial planning competence”.

Industry requirements –we train students to achieve the following professional certificates:

the government requires a tax- internship at the National Taxation Bureau

Civil servants: Public officers at tax authorities

Specialized technical personnel: Bookkeepers, accountants

Financial accounting personnel: Financial accounting and taxation personnel at enterprises and public accountants’ firms

Banking institutions: Taxation planning personnel

|

|

Tax service at National Taxation Bureau of Banqiao |

Champion of women's tug of war at university anniversary celebration |

|

|

Taxation innovation e-seminar |

Student tax service team at Department of Banking and Finance |

|

|

Summer camp of Department of Banking and Finance |

Chairperson:+886-2-2658-5801#2710 / ac@takming.edu.tw

Secretary:+886-2-2658-5801#2711 / ad870805@takming.edu.tw

The Department of Accounting Information dates back to when the university was founded in 1965. In 2004, it was renamed with the current title. Currently, the Department offers six classes for four-year technical students in the day school. The courses include: one class for the industry-university foreign student program, and three classes for the foreign student program. There are around 421 students in total. The faulty structure includes one professor, seven associate professors, and three assistant professors. All faculty members have a PhD degree. Among them, one is a qualified public accountant and another is a qualified securities analyst. We also hire industrial experts who have practical experience of working in accountancy firms and senior managers at the division of finance and accounting in companies as guest lectures. This helps students to closely link accounting theories to practical learning.

The development vision of the Department is to cultivate professional accounting information application skills by way of basic academic theory, practical internship experience, and workplace ethics. We position ourselves as facilitators for a practical and applicable vocational education system, and aim to equip students with the all-round accounting skills required to perform their specialty in accounting and accounting information in different industries. The Department also considers the professional development of accounting specialists and the change in their roles in the workplace to design a curriculum that meets industrial demand. To this end, it conducts teacher training programs for relevant courses. Each development feature in the Department focuses on the above to direct further development and curriculum design. The key characteristics are set out below:

(1)Specialization on basic knowledge; (2) Informatization on the curriculum; (3) Practical training; (4) Professional accounting with recognition of the diversity in banking, finance, and the law

The main employment for graduates from our department includes:

(1) Advanced study: courses at domestic and overseas graduate schools related to accounting and business management.

(2) Employment:

1. Bookkeeping, auditing, and auditors at accountancy firms or in bookkeepers’ offices.

2. Financial accounting personnel at departments of finance and accounting in various enterprises.

3. Administrators at departments of general affairs in various enterprises.

4.Accounting personnel at government agencies.

5.Accountants and bookkeepers.

6.Financial accounting data analysis personnel.

|

|

2020 Alumni Gathering 1 |

2020 Alumni Gathering 2 |

|

|

2020 Alumni Gathering – Awarding Scholarship |

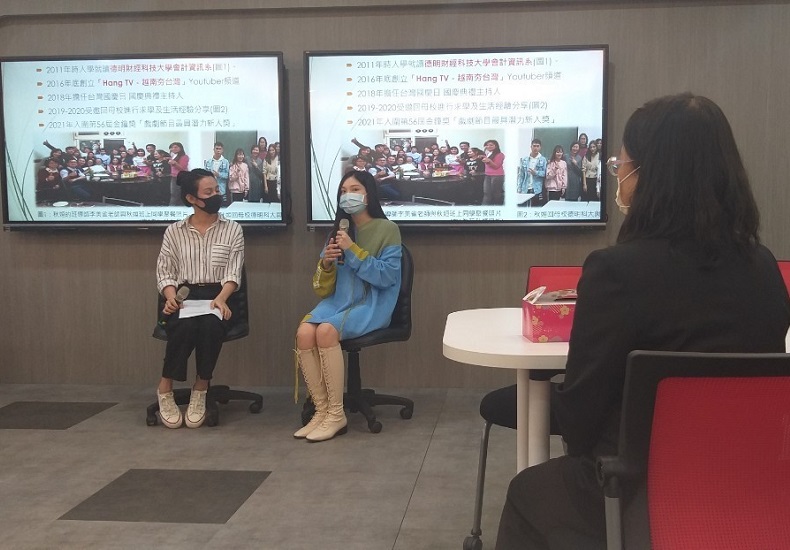

Teachers at our department take a photo with our outstanding alumnus, Nguyễn Thu Hằng (the third from the left) |

|

|

Interview with our Vietnamese outstanding alumnus, Nguyễn Thu Hằng |

Accounting 1A Freshman Orientation 1 |

|

|

Accounting 1A Freshman Orientation 2 |

Head of the Department of Accounting Information takes a photo with our Vietnamese outstanding alumnus, Nguyễn Thu Hằng |